(pages TRG 5-6) sa150

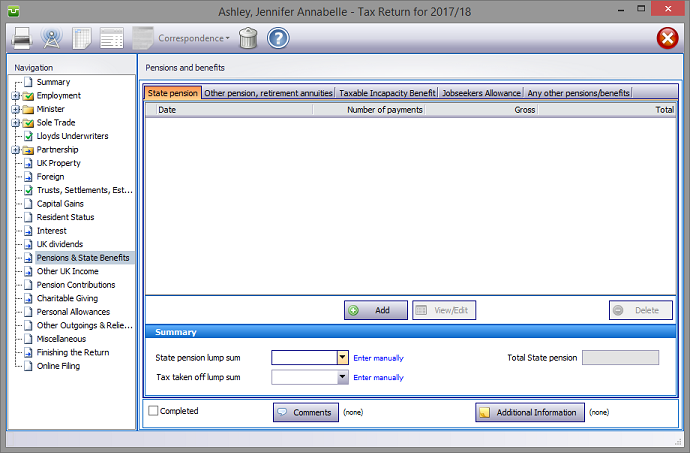

In the Navigation pane click on Pensions and State Benefits and select the relevant tab.

Please read the HMRC document sa150.

Pensions and State Benefits details

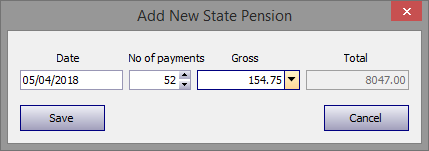

Click on the tab, hit the Add button to make the appropriate entries, entering data is intuitive and self explanatory.

Enter any lump sum and tax suffered by deduction manually in the Summary section at the bottom of the Pensions and benefits screen.

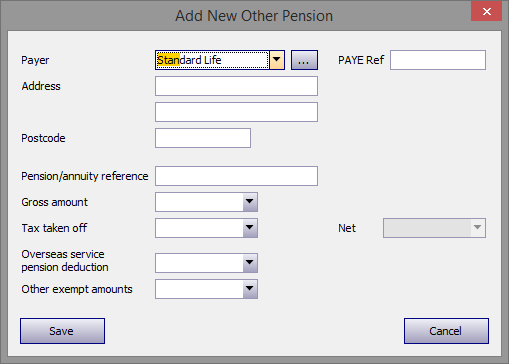

Other pension, retirement annuities

Click on the tab, hit the Add button to make the appropriate entries, entering data is intuitive and self explanatory.

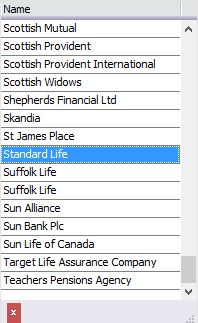

The program contains a database of the major pension providers. Enter the first few letters of the company concerned and the name of the first one commencing with those letters appears in the Payer box. (in the example the letters "Sta" have been entered)‡ Click on the downward pointing arrow to the right of this box to see the other companies whose names begin with these letters.

Proceed by entering the relevant data and hit Save.

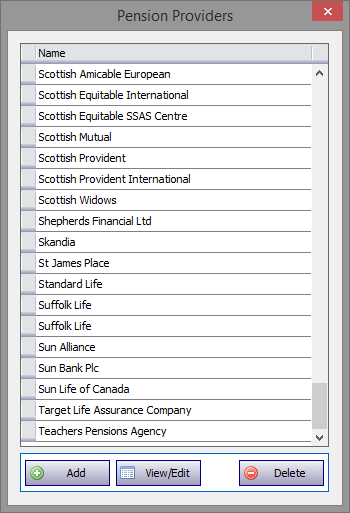

If the pension provider you seek is not in the database click on the ellipsis (...) to the right of the Payer box to add, delete or edit a provider's details.

‡ Alternatively click on the downward pointing arrow and scroll down the list of providers in the database.

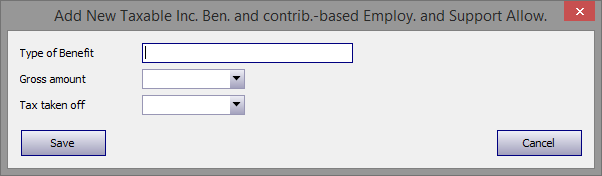

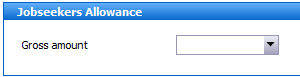

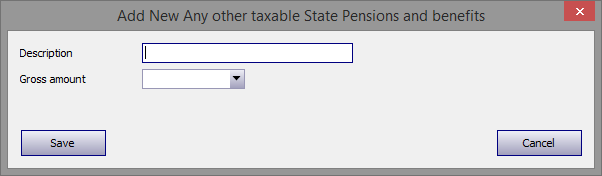

Taxable Incapacity Benefit, Jobseekers Allowance, Any other pensions/benefits

Click on the tab, hit the Add button to make the appropriate entries, entering data is intuitive and self explanatory.

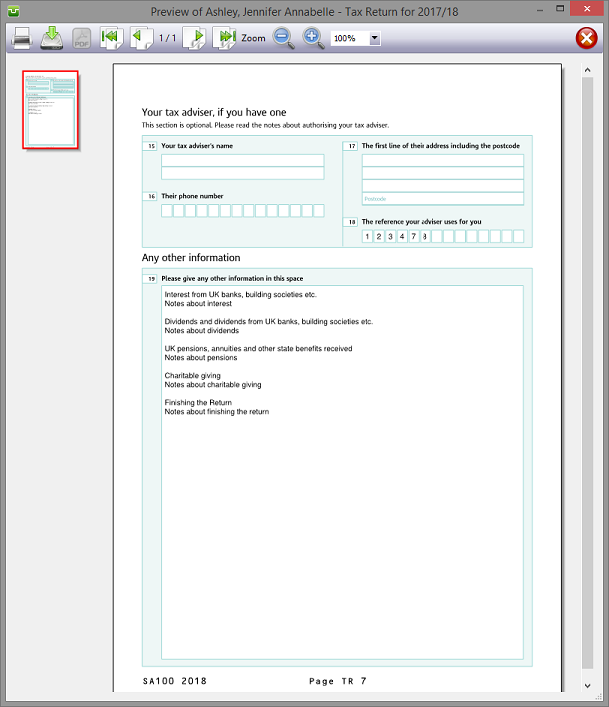

Entries made on the Additional Information area will be printed in box 19 on page TR7 of form sa100. Entries made via Comments are for information only and do not appear on the return or the supplementary pages. The first few words of additional information/comments appear to the right of the relevant boxes.

Finishing

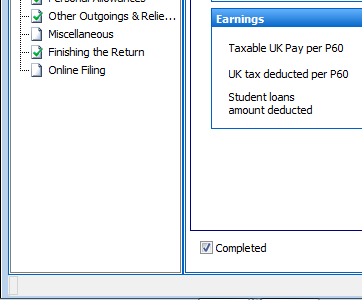

When no further entries are necessary check the Completed tick box in the lower left hand corner of the screen. Although doing this does not preclude further entries or amendments the online submission process will not proceed if there are unchecked boxes in sections containing data.

A small green tick in the relevant section on the left hand pane confirms that the Completion box is checked.

| Notes |

| sa150 |

| Page TRG 5-6 |

Copyright © 2025 Topup Software Limited All rights reserved.